The report for the fourth quarter of last year and the entire 2022 from Canalys is now available. For the first time ever, Q4 shipments were lower than Q3 shipments. The fourth quarter experienced a staggering 27% year-over-year drop in volumes, contributing to a 6% annual decline compared to 2021.

Since 2017, Samsung has been runner-up to Xiaomi as the largest smartphone vendor in India, but in the most recent quarter, Samsung reclaimed the top spot. However, the latter holds the top spot throughout all of 2022.

Samsung’s 2022 shipments were down 21%, but the company still held a 21% share of the Indian market in the fourth quarter, which was up 2% from the same period in the previous year. Vivo’s 13% increase in sales put them in second place, behind only Huawei, with 20% of the market.

With a 40% reduction in sales in Q4, Xiaomi was knocked down to third place, just ahead of Oppo, which grew by 10% and fell short by less than 100,000 units.

Even worse than in Q3, Realme shipped only a third as many devices in Q4 2022, putting it in a distant fifth place.

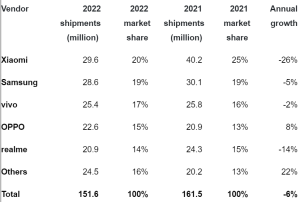

For the year 2022 as a whole, Xiaomi still holds the largest market share (20%), but it has lost the most ground of any major player, with a loss of over 25% in shipments.

Samsung is in second place, as it was in 2021; however, the gap between them has shrunk from 10M to 1M sold units. Vivo is now in third place, a significant jump from its position a year ago.

With higher sales this year compared to the previous year, Oppo moved up to fourth place, surpassing its sibling company Realme.

According to Canalys, Oppo and vivo’s better performance can be attributed to their smoother operations throughout India’s holiday season. By concentrating on non-digital distribution methods, they were able to sidestep the worst of what was happening to online retailers.

Many experts predict that 2023 would be a rather slow year due to the worsening global economic crisis, but that growth will resume in the Indian market the following year, in 2024.